Are you curious about the cost of business license in Dubai and how it might affect your plans for 2025? You’re not alone. Many aspiring entrepreneurs and international investors share the same question as they gear up to launch their ventures in one of the Middle East’s most dynamic markets. In the sections below, you’ll find a thorough breakdown of what goes into the license fees, how mainland areas differ from free zones, and practical tips on minimizing expenses. By the end, you’ll have a clear path to confidently budget for your new Dubai-based business.

Understanding The Cost Landscape

A business license in Dubai is essentially your official ticket to operate within the UAE’s legal framework. While the total bill can fluctuate based on multiple factors such as your specific business activity, the license category, or whether you’re going mainland or free zone there are some consistent elements to expect. In general, licenses in Dubai can cost anywhere from around 12,000 AED to well over 50,000 AED, depending on your requirements.

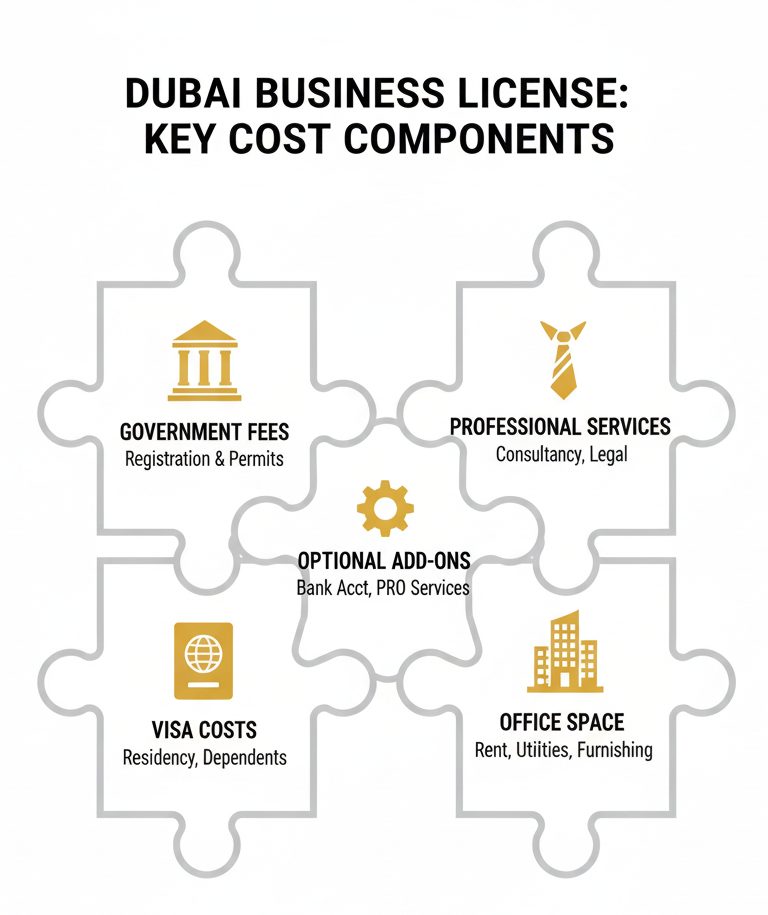

Despite these varying price tags, you may find it surprisingly straightforward to estimate a ballpark figure once you grasp the key cost drivers. Think of it like piecing together a puzzle: government fees, professional service charges, visa concerns, and other must-have approvals all contribute to the final picture. If you plan wisely, you can avoid unforeseen expenses that could derail your budget.

Why Licensing Matters

Licensing isn’t just a formality it carries real legal weight. Operating without the correct license could lead to heavy penalties or even forced closure of your operation. The Dubai economy is built on transparency, which protects both you and your potential customers. Securing your license properly also builds credibility. When clients see you’re licensed and compliant, they’ll be more likely to trust your brand.

Setting Expectations For 2025

You might be wondering, “What makes 2025 so special for licensing in Dubai?” The government frequently updates regulations to encourage foreign investment and stimulate economic growth. These initiatives could mean changes in fees or new types of business licenses geared toward emerging industries like crypto trading or sustainable technologies. Always keep an eye on the latest business announcements, so you can adapt your budget if new rules or incentives pop up.

| Category | What’s included | Est. Cost (AED) |

|---|---|---|

|

Government Authority Fees DED (mainland) or free-zone authority |

Trade name reservation, initial approval, license issuance.

Extra approvals may apply for regulated activities.

|

Varies by activity Package-dependent |

|

Professional / PRO Services Paperwork, attestations, filings |

Document prep, translations, government runs, compliance filing. | ~2,000–8,000+ |

|

Local Sponsor / Service Agent (if required) Mainland structures & select activities |

Sponsor/agent agreement, annual fee per terms. | ~5,000–25,000+ |

|

Facility & Office Space Tenancy (mainland) orflex-desk (FZ) |

Lease or flex-desk package, Ejari/permit where applicable. | Location-dependent Package-based |

|

Visa & Immigration Owner, employees,dependents |

Quota, medicals, Emirates ID, stamping. | ~2,000–4,000 / visa + optional urgent |

|

Optional Add-Ons Accounting, tax, insurance, training |

Bookkeeping & VAT/CT filings, professional indemnity, role-specific training. | Plan-based |

Breaking Down The Fees

When you hear about license costs, the final figure might seem like one lump sum. In reality, it helps to unpack each line item. Below are the expenses you should expect in typical license packages though the exact numbers can vary across different authorities and service providers.

Government Authority Fees

Any official business setup starts at the government level. You’ll pay fees to the Department of Economic Development (DED) if you choose a mainland license. Meanwhile, free zone authorities have their own schedule of charges. These government-imposed fees generally cover:

- Trade name reservation.

- Initial approval for business activities.

- Issuance of the final license.

The precise cost will hinge on your industry and the number of activities you plan to conduct under a single license. Some businesses need multiple approvals (like for specialized training or food handling), which can add a bit more to the tab.

Professional Service Charges

You might decide to hire consultants or PRO services to handle paperwork, legal documentation, and approvals. They’ll streamline the entire licensing process, which can save you time especially if you’re months away from a crucial product launch. But that convenience often comes at an extra cost. Professional fees could be a few thousand dirhams, on top of the baseline government charges.

If you aim to reduce expenses, consider doing some of the legwork yourself, such as gathering required documents or scheduling appointments at government offices. On the flip side, if you value a quick, efficient setup, that investment in professional help may be worth every dirham.

Local Sponsor Or Service Agency

In mainland Dubai, certain business structures require a local Emirati sponsor or service agent. This sponsor may hold a percentage of your company shares on paper, despite progressive ownership reforms introduced in recent years. While 100% business ownership is now possible for many activities, not all sectors are eligible for full foreign ownership.

If you do need a sponsor, you’ll negotiate an annual sponsorship fee. This figure can range widely think anywhere from 5,000 AED to well above 25,000 AED depending on the sponsor’s reputation and the complexity of your business arrangement. Always clarify what services or support the sponsor will extend, so both sides understand the terms.

Facility And Office Space

Even if you’re now allowed to run a business without an office in the uae in certain situations, many entrepreneurs still prefer having a physical space. For mainland entities, a tenancy contract in an approved commercial zone is often mandatory. Free zones typically offer flexible desk or office space packages.

Office rent adds a substantial line item to your budget, especially in premium neighborhoods. If you want to trim costs, consider a free zone with built-in flexible options or use co-working spaces that meet license requirements.

Visa And Immigration Expenses

You’ll likely need residency visas for yourself, employees, and possibly your family members. Visa quotas differ based on your business activity and office space. Each visa application involves medical tests, Emirates ID fees, and other administrative costs.

You should budget for at least 2,000–4,000 AED per visa, not counting potential costs for urgent processing or additional dependents. If you plan to bring over multiple workers, these figures can accumulate quickly so be sure to account for them in your business plan.

Optional Add-Ons

Once you have your license, you might need ongoing operational elements like accounting and bookkeeping, tax consultancy for compliance with the UAE’s corporate tax environment, or specialized training for staff. Some of these services might be optional, but they can substantially lighten your administrative load and keep you within legal bounds.

Comparing Mainland And Free Zones

One of the first key decisions you’ll make is whether to select a mainland license or operate within a free zone. Each structure has direct cost implications that can shape your overall budget.

Mainland License Costs

A mainland setup typically gives you the freedom to trade anywhere in Dubai, the broader UAE, or even internationally but you’ll pay for that flexibility. Fees may include:

- Department of Economic Development (DED) charges.

- Local sponsor or partner fees, if required.

- Municipality fees for facility approvals.

You also need an office, which can raise your total overhead. If your goal is to secure government contracts or pitch your services to clients throughout the Emirates, the mainland route can be well worth the extra cost.

Free Zone License Costs

Free zones in Dubai are designated areas that cater to specific industries and allow 100% foreign ownership for most activities. They typically bundle license, visa, and office solutions into one package. Some free zones even offer specialized services like crypto trading business license in the uae or e-commerce permits.

These packages can mean lower upfront costs compared to many mainland licenses. On the flip side, you’ll have certain trading restrictions outside of the free zone and might need a local distributor if you want to sell on the UAE mainland. Check out mainland vs free zone for a more detailed comparison of these license types.

Choosing The Best Fit

Ultimately, weigh your business model against the pros and cons of each location. If you need maximum market access across the UAE, a mainland license might justify the higher fees. If your priority is cost control and niche trading, a free zone environment could be ideal. Remember, it’s not just about the cost of business license in Dubai, but also about your long-term operational strategy.

Considering Additional Expenses

Beyond the licensing cost itself, a range of add-on fees can sneak up on you. Here’s what to factor in so you’re not blindsided along the way.

Government Registrations

Certain activities require special approvals from agencies like the Dubai Health Authority or the Dubai Municipality. These extra steps often come with their own fees in addition to your core license. If you’re in a regulated field such as healthcare or specialized manufacturing expect more layers of documentation.

Document Attestations

If you’re relocating from abroad or bringing in foreign staff, you may need to authenticate documents like degrees and certifications. Document attestation has its own associated costs, from notary public stamps to embassy approvals. Each piece of paper can set you back a few hundred dirhams, so keep these charges in mind.

Insurance Requirements

Some licenses require you to carry specific insurance policies, such as professional indemnity or product liability coverage. While insurance costs vary based on your risk profile, they’re worth investigating early. This helps you plan ahead and steer clear of last-minute surprises, particularly if you want to secure larger client contracts that demand proof of insurance.

Additional Services

Starting a business often goes hand in hand with banking, advanced digital infrastructure, or specialized consulting. For instance, setting up a business bank account might be straightforward, but if you need premium corporate banking with multiple currency accounts, you might face monthly charges or annual fees.

Some entrepreneurs also sign up for concierge services, which handle everything from utility registrations to office fit-outs. While these services can significantly reduce the hassle factor, you should budget carefully to avoid overspending in your early months.

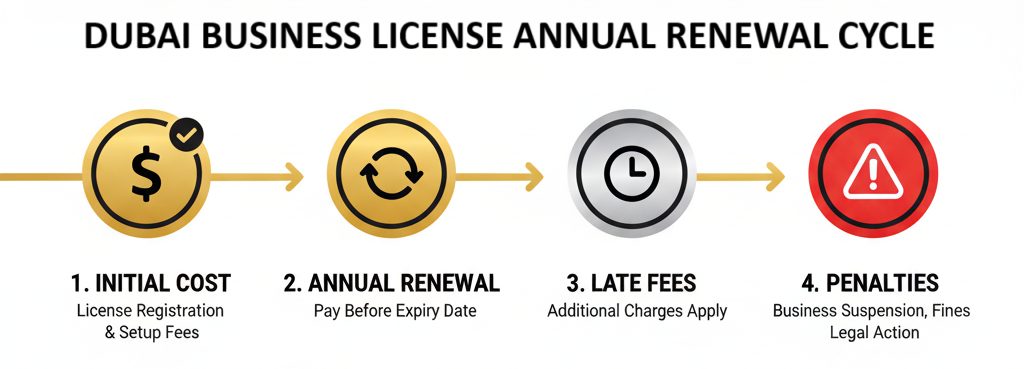

Budgeting For License Renewals

It’s easy to focus on the initial setup cost. However, don’t forget that you’ll need to renew your license annually or at another specified interval to remain compliant. Renewal fees are often similar to, or slightly less than, initial costs, but they can still be substantial.

Anticipating Yearly Obligations

Yearly renewal charges can include:

- Official government fees for the license.

- Office lease, if that’s part of the requirement.

- Sponsor or agent fees, if you have a mainland setup.

- Visa renewals for yourself and staff.

If you run a free zone company, your renewal package will depend on the free zone’s policies. Some free zones may offer multi-year deals at a discount, so be sure to ask about any available promotions. Proper budgeting for renewals means you won’t get ambushed by a big bill every time your anniversary date rolls around.

Dealing With Late Renewals

If you let your license lapse, you could face fines or restrictions on business activities. Some authorities are quicker to penalize tardiness than others, but it’s never a good idea to push your luck. Late fees can be steep, and the risk of operational disruptions could cost you far more than the renewal itself.

Exploring Cost-Saving Methods

Wondering how to shave off a few thousand dirhams (or more) from your license budget? You can look into combining certain processes, choosing budget-friendly office solutions, or leveraging special incentives offered by the government or free zones.

Bundled Service Packages

Various licensing authorities roll out bundled deals that combine the cost of your license, furnished office desks, visa quotas, and other perks. These packages can be a genuine money-saver if they align with your actual needs. Shop around and compare packages meticulously. Sometimes the lowest advertised price omits hidden extras, so always confirm precisely what you’re getting.

Strategic Location Choices

Selecting a slightly less central free zone or a mainland area off the beaten path could mean significantly lower rent. Think about your client base: if most of your transactions happen online or you only occasionally meet clients in person, consider a more affordable location. Conversely, an A-grade office in the heart of Dubai might elevate your image, but the additional costs might not always pay off in the early stages of your venture.

Leveraging Government Incentives

Dubai’s leadership is eager to attract global business, and they frequently announce initiatives aimed at reducing startup hurdles. These can range from discounted license fees for innovative tech companies to flexible payment plans for small and medium enterprises. Stay tuned to official channels and ask local experts about upcoming promotions or business setup in uae campaigns. Timing your application during a special offer can translate into real savings.

Optimizing Service Usage

Do you really need daily administrative help, or can you manage with a part-time assistant? Would a virtual receptionist work just as well as a staffed front desk in your office? Trimming operational extras can free up resources for more important investments. Consider whether you can streamline logistics, lighten your monthly overhead, and boost your bottom line.

Avoiding Common Pitfalls

Sadly, some businesses run into unnecessary setbacks when they skip critical steps or fail to budget correctly. Here are pitfalls you want to steer clear of as you navigate license fees in Dubai.

Underestimating Sponsor Costs

If you’re going mainland, verify that you fully understand your sponsor’s fees and obligations. Sometimes, hidden clauses in your sponsorship agreement can lead to unexpected charges or complicated disputes. Make sure you have a clear, legally vetted contract to avoid confusion later.

Overlooking Compliance Obligations

Dubai is serious about compliance. Many new entrepreneurs underestimate how much time and money it can take to stay on top of regulations. Engaging professional compliance services is an investment that can prevent fines or legal conflicts. Failing to keep track of regulatory changes makes your business vulnerable, especially if authorities introduce new requirements partway through the year.

Ignoring Renewal Timelines

Because the initial computing of business license expenses typically consumes a lot of attention, some owners completely forget about renewal dates. Late or lapsed licenses can bring on hefty fines and reputational damage. Create a system be it a digital calendar alert or a dedicated compliance officer to ensure you stay on track with renewals.

Relying On Outdated Information

Chances are, you’ve heard stories about someone who set up a company in Dubai for a dirt-cheap rate a decade ago. Regulations, incentives, and fee structures shift often. Make sure you rely on up-to-date resources or localized experts who know exactly what’s happening in 2025. Otherwise, you could end up budgeting based on expired data.

Quiz: Avoiding Common Pitfalls

Which mistake do most new entrepreneurs make in Dubai?

✅ Correct! All of these are common pitfalls — overlooking sponsors, renewals, and updated rules can cost you heavily. Stay informed and plan ahead.

Completing The License Process

You’ve considered the costs, weighed mainland vs free zone options, and mapped out how additional fees might affect your bottom line. So, how do you put it all into action? Below is a general step-by-step approach.

- Clarify Your Activity

Determine exactly what commercial activity you plan to engage in. If you’re unsure which category your proposed business falls under, refer to official lists or consult an advisor. - Choose A Region

Decide if your firm will thrive in a mainland environment or if a free zone suits your goals more effectively. Each pathway brings its own cost structure, so confirm your choice before diving into paperwork. - Check Sponsorship Needs

If you need a local sponsor to satisfy legal requirements, start vetting potential partners. Negotiate fees and articulate each party’s expectations upfront. - Prepare The Documents

Gather passports, proof of address, and any certificates needed for specialized activities. If you anticipate complicated approvals, consider how to setup a business in the uae resources or enlist reputable agents. - Submit Applications

File your trade name reservation, initial approval, and final license application. Make sure you are aware of the deadlines for follow-up tasks, such as office registration or visa processing. - Complete Visa Processes

If applicable, proceed with residency visa applications for yourself and any team members or dependents. Budget for medical tests, Emirates ID, and potential urgent processing fees. - Finalize Office Details

Secure a tenancy contract or finalize a free zone office package. Organize the actual fit-out and any necessary approvals from relevant authorities (like civil defense inspections, if needed). - Get The License

After verifying all requirements and paying the required fees in full, the authorities will issue your official trade license. Congratulations you’re now legally authorized to do business in Dubai. - Renew Promptly

Mark your calendar for renewal deadlines. Keep track of your business’s paperwork and weed out any compliance gaps to maintain a clean record.

Conclusion And Next Steps

Figuring out the cost of a business license in Dubai may seem daunting at first, but it becomes much easier to handle when you break it down into practical steps. You’ve learned how various fees from government approvals to sponsor costs shape your overall budget. You’ve also explored the differences between mainland and free zone structures and discovered strategies to cut down on unnecessary expenses. With these insights in mind, you’re well on your way to establishing a strong financial foundation for your future enterprise.

Before you officially dive in, it may help to draft a brief business plan for a uae company. Outline your anticipated revenues, map out monthly operating costs, and identify where a license fits into your broader strategy. This foresight might also keep you safe if new regulations emerge or if you decide to expand beyond Dubai. If you have lingering questions or want help smoothing out the process, local experts and official business setup resources can guide you through each step.

Ready to take the plunge? Start by confirming your preferred licensing route, setting aside the necessary budget, and opening dialogue with relevant authorities or professional consultants. Dubai is a land of opportunities but it’s also a place where due diligence and proper planning truly pay off. By staying on top of compliance and renewing your license in a timely manner, you’ll be better positioned to grow, diversify, and prosper in the UAE’s ever-evolving market. Good luck, and here’s to seeing your venture thrive in 2025 and beyond!

Ready to set up in Dubai?

Get a tailored cost plan and licensing route for 2025. Speak with a Wealth Tellers specialist and start with clarity.