VAT for small businesses in the UAE is a fundamental consideration when you’re launching or expanding your venture in this dynamic market. Understanding how Value Added Tax affects you helps you stay on the right side of regulations and maintain a healthy bottom line. Below, you’ll find the key points you need to know, from registration basics to ongoing compliance, all to keep your small business running smoothly.

Understand The Basics Of VAT

What Is VAT?

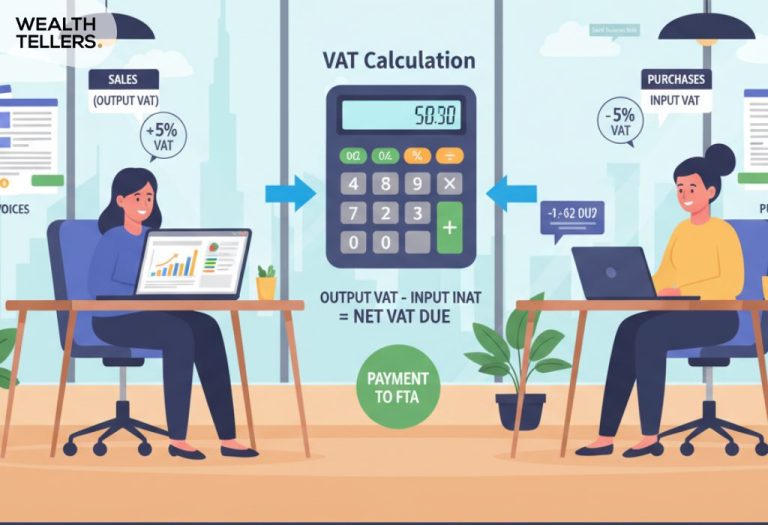

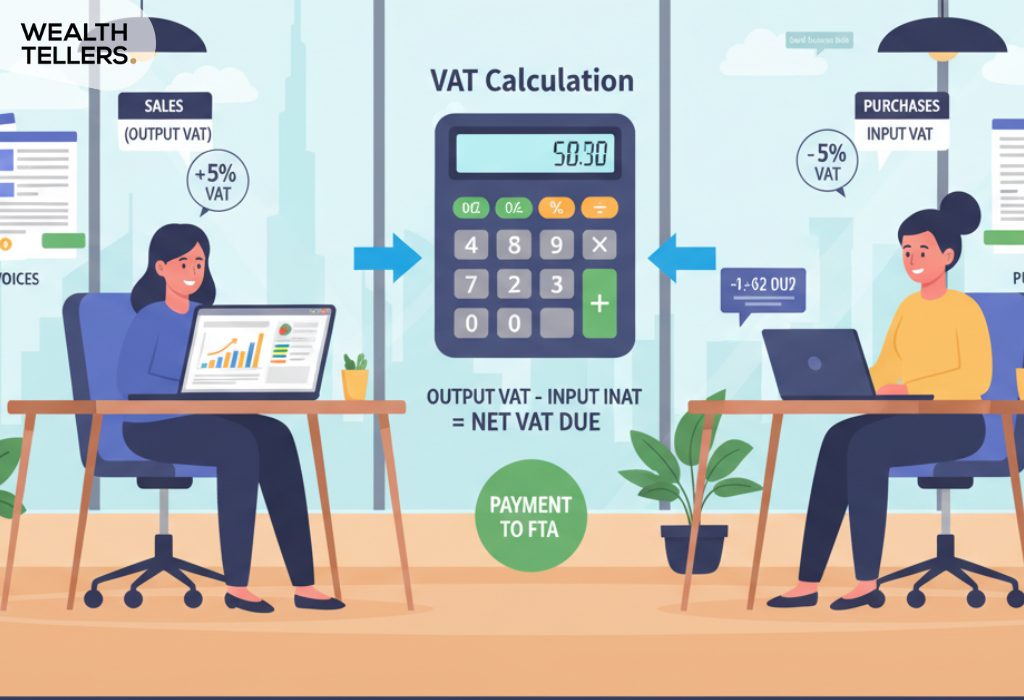

Value Added Tax is a consumption-based levy applied to goods and services. In the UAE, VAT is typically charged at each stage of the supply chain, meaning you collect it from customers and then remit it to the authorities. As the name suggests, this tax is based on the “added value” that occurs at each point where a business transforms or adds worth to a product or service.

Why It Matters For You

When you’re running a small business in the UAE, VAT isn’t just a bureaucratic formality. Timely registration (if required), accurate invoicing, and careful record-keeping can all impact your company’s finances. By taking VAT obligations seriously, you’ll minimize the risk of penalties, safeguard your reputation, and foster trust with customers and suppliers.

VAT essentials to keep under control

- ✓Track revenue monthly so you know when you’re approaching the VAT registration threshold.

- ✓Issue invoices consistently and store them in one place (sales, purchases, credit notes).

- ✓Keep receipts and expense proof so input VAT claims are easy to justify later.

- ✓Set calendar reminders for VAT return due dates to avoid late filing penalties.

- ✓Recheck pricing and cash flow so VAT collection doesn’t surprise your margins.

Check If You Must Register

Revenue Threshold Consideration

Certain small businesses must register for VAT if their annual revenue crosses the mandated threshold. Regularly monitoring your revenue flow is crucial if you’re getting close to the limit, it’s wise to prepare in advance. Remember that voluntary registration is also an option, especially if you foresee steady growth in the near future.

VAT registration: when to act

| Situation | What to do | Why it helps |

|---|---|---|

| Your revenue is nearing the required threshold | Start preparing documents, clean up bookkeeping, and forecast the next 3–6 months | Reduces last-minute mistakes and helps you plan VAT impact on pricing and cash flow |

| Your revenue crosses the mandated threshold | Register for VAT and switch to VAT-ready invoicing and record-keeping immediately | Keeps you compliant and avoids penalties from delayed registration or incorrect invoices |

| You expect steady growth soon | Consider voluntary registration if it fits your business plan | Helps you operate with a consistent VAT process and may improve credibility with partners |

| You sell to other VAT-registered businesses | Keep purchase invoices organized so input VAT tracking is simple | Makes returns easier and supports accurate VAT reclaims (where applicable) |

If you haven’t yet decided whether you’ll operate on the Mainland or in a Free Zone, it’s worth comparing structures. You might find it helpful to explore mainland vs free zone to see which approach best meets your VAT and overall business needs. Additionally, if you’re leaning toward a Free Zone setup, you can check out the cost to setup freezone company in uae.

Gather All Required Records

Even if you aren’t immediately registering for VAT, good bookkeeping habits protect your business. Keeping detailed sales records, expense receipts, and bank statements helps you calculate VAT payments or refunds accurately. You’ll also have a clear trail to present during official audits.

Simple VAT compliance cycle (small business view)

Track sales + expenses

Keep invoices, receipts, and bank records organized from day one.

Know your VAT position

Understand what you collected from customers and what you may reclaim (where applicable).

Prepare the VAT return

Reconcile totals so your return matches your bookkeeping and invoices.

File on time + pay

Submit within deadlines and pay due amounts to avoid penalties.

Manage Regular Returns

Filing Deadlines

Once you’re registered, your business is required to submit VAT returns periodically. Make sure to mark these filing dates on your calendar and set reminders to avoid last-minute scrambles. Submitting accurate returns also helps you maintain confidence in your cash flow, since you’ll know exactly how much VAT you owe or need to reclaim.

Quick VAT questions small businesses ask

What should I keep ready for VAT returns?

Why are filing deadlines important?

What if my records are messy?

How do I avoid VAT surprises in my cash flow?

Penalties And Compliance

Paying late or filing incomplete returns can lead to penalties that chip away at your profits. Moreover, non-compliance can harm your reputation, particularly in the UAE’s well-regulated business environment. If you’re unsure about any part of the VAT process, consulting a financial professional is often worth the investment.

Quick quiz: Are you VAT-ready?

Answer these 4 questions to see where you stand. This is a simple self-check, not legal advice.

Pick The Right License For Your Business

VAT obligations can vary depending on the nature of your operations and where you register your company. For example, certain small-scale activities might enjoy varied treatment from regulators. To learn more, visit do small businesses need a license in dubai? or explore further insights into business setup in uae.

By treating VAT as a core part of your business plan, you’re already taking a step in the right direction. Whether you plan to start small or grow quickly, understanding your tax obligations now will save you from headaches and potential penalties in the future. Above all, stay informed, keep meticulous records, and consider professional guidance if you need personalized support. Here’s to your success in the UAE’s thriving market.

Need help with VAT setup and compliance in the UAE?

Get clear guidance on registration readiness, record-keeping, and filing so you stay compliant and protect your cash flow.