If you are looking to expand your global footprint, opening a business bank account in the UAE is one of the first steps toward getting established. A local account simplifies day-to-day transactions, keeps personal and corporate finances separate, and enhances your company’s professional image. In this guide, you will learn the basics of choosing a reputable bank, preparing the right paperwork, and speeding up your application. Let’s explore how you can set up your account with minimal hassle.

Understand The Importance Of A UAE Business Bank Account

A dedicated business bank account in the UAE does more than store your funds, it also shows clients, suppliers, and investors that your company is legitimate. By banking locally, you can:

- Demonstrate your presence in the UAE market.

- Access tailored financial solutions, including credit lines and corporate cards.

- Enjoy smoother payments from clients in the region.

This step is especially crucial if you plan to grow your operation. If you have not yet decided on the legal structure of your enterprise, be sure to explore business structures in the uae to ensure you choose a setup that meets your banking needs.

Prepare The Essential Documents

Before applying, make sure you have a clear understanding of your company’s licensing and structure. Required documentation often includes:

- Proof of business registration: A valid trade license, certificate of incorporation, or other official confirmation.

- Shareholder information: Copies of passports, visas, and residency details for all partners.

- Memorandum of association or equivalent: Details about the company’s goals, structure, and capital contributions.

- Proof of address: A recent utility bill or tenancy contract to confirm your physical or registered office address.

- Business plan or financial forecasts: Some banks may require a short overview of your operations and revenue projects.

Essential Documents Checklist

| Document | Description |

|---|---|

| Proof of business registration | Trade license or incorporation certificate |

| Shareholder information | Passports and visas if available |

| Memorandum of association | Company goals and structure |

| Proof of address | Utility bill or tenancy agreement |

| Business plan | Short overview if required by bank |

As you gather these documents, consider using compliance services or pro services to help navigate local regulations swiftly.

Pick And Approach The Right Bank

Choosing the right bank is a balancing act of comparing fees, minimum balance requirements, and available services. Here are a few considerations:

Bank Comparison Points

| Criteria | What to check |

|---|---|

| Fees | Monthly account and transaction fees |

| Minimum balance | Required deposit threshold |

| Digital services | Mobile app and online access |

| Support | Availability of relationship manager |

- Bank reputation: Look for well-established banks with strong ratings or reviews in the UAE.

- Branch network: If you often visit multiple emirates, having convenient branch locations can save you time.

- Digital services: Check if the mobile banking app is user-friendly and whether you can manage most transactions online.

- Customer support: A reliable customer service line or dedicated relationship manager may prove invaluable if you encounter any issues.

If you want to explore full-scale banking solutions in the country, check out corporate banking offerings to see which package aligns best with your future expansion.

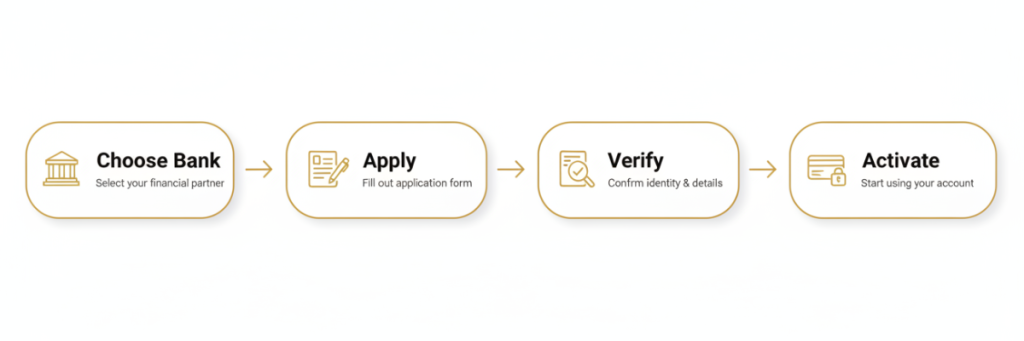

Submit Your Application

Once you decide on a bank, schedule an appointment or start an online application if available. Submit your documentation in an organized format, and be ready to:

- Answer questions about your business model and funding sources.

- Provide details on expected monthly transactions or turnover.

- Verify the personal identities of all directors or shareholders.

Different banks have varying processing times. After submission, keep an eye on your email and phone for approval updates or requests for additional information.

Manage And Maintain Your Account

When your account is fully activated, you can immediately begin depositing revenue and paying expenses. To keep your finances in top shape:

- Stay organized with regular accounting and bookkeeping so all cash flow is tracked and categorized.

- Maintain the required minimum balance to avoid fees.

- Sign up for online banking alerts so you never miss a transaction.

If you run into any obstacles, reach out promptly to your relationship manager or the bank’s support service. Early communication is the key to resolving issues before they escalate.

Key Tips And Considerations

- Double-check your trade license status before applying. Inactive or expired licenses can delay applications.

- Prepare a concise summary of your business plan, including target markets and projected revenue streams.

- Keep personal and company funds separate. Combining finances can lead to tax and compliance complications.

- Explore additional services, such as tax consultancy, if you need professional advice on complex regulations.

By partnering with the right bank and following these steps, you can open a business bank account in the UAE quickly and confidently. An active account will not only simplify your payments but also provide the financial foundation you need for growth in this dynamic market.

Open Your UAE Business Bank Account Easily

Get guided steps to set up your bank account and simplify your business operations in the UAE.