In many ways, forming a company in the United Arab Emirates (UAE) offers you a gateway to a dynamic global market. However, you may find yourself weighing mainland vs free zone options as you plan your venture. This choice plays a major role in shaping how you operate, what you pay, and the type of ownership and visas you can secure. Below, you’ll discover a clear comparison of these two paths so you can choose the one that best matches your goals and resources.

Good news you’re not alone in this decision, and you have plenty of flexibility to tailor your setup to your unique business needs. Let’s break down what mainland and free zone formations look like, compare their costs, clarify ownership rules, explore visa frameworks, and highlight practical considerations for your next steps.

Compare Mainland and Free Zone

Before diving into specifics, it’s helpful to see a broad snapshot of why each route appeals to various entrepreneurs. The table below summarizes some core differences, so you can quickly spot which path might align with your vision.

| Category | Mainland | Free Zone |

|---|---|---|

| Market Access | Full UAE market access, no barriers | Restricted mainly to free zone or external trade |

| Ownership | 100% foreign ownership allowed (in many sectors) but may vary | Typically 100% foreign ownership |

| Costs | Often higher office costs, some local fees | Generally lower initial setup costs, specific free zone fees |

| Visa Options | Flexible, can sponsor many visas | Limited number of visas per office size |

| Business Scope | Diverse, can operate across multiple activities | Usually narrower range of permitted activities |

This overview is just the start. You’ll need to consider your top priorities whether that’s lower fees, full onshore trading, or easy visa sponsorship and match them to the path that works best for you.

Understand Mainland Formation

Operating in the mainland of the UAE means you can freely do business both within the local market and abroad. While regulations have evolved in recent years (notably around foreign ownership), there are a few core points that remain essential. From handling local licenses to renting office space, you’ll want to clarify each layer of the process before you commit.

Licensing and Business Activities

If you decide to form a mainland company, you’ll typically start by identifying the legal entity type that fits your business scope. The Department of Economic Development (for each emirate) usually oversees licensing, issuing approvals for everything from retail outlets to consulting firms. Most business categories are available on the mainland, which is a big plus if you plan to sell products or services directly to the local population.

- Mainland companies can generally participate in a wide range of sectors, including commercial, professional, and industrial activities.

- License fees can vary depending on your emirate and the nature of your business.

- You’ll often need a physical office address to obtain and maintain your license.

For a broader view of how licensing works in the UAE, you can check out types of business licenses in the uae. This resource can clarify the main distinctions and help you narrow down which license category fits your operation.

Ownership Policies and Controls

Over the past few years, regulations in many emirates now allow 100% foreign ownership in specific sectors. Previously, you typically needed a local sponsor or a local service agent for certain activity types, but that’s not always the case anymore. However, some strategic industries (particularly in sectors like oil and gas, transport, or government-related segments) still require local involvement.

If your sector requires a local partner, you’ll want to have a clear, transparent agreement that spells out profit-sharing and decision-making authority. This ensures you have a stable relationship with your local sponsor or partner, which can save you from disputes later on.

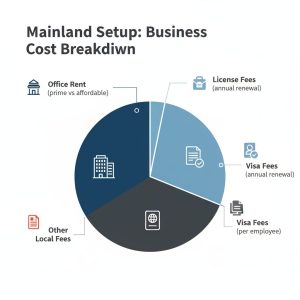

Mainland Costs and Office Requirements

Costs on the mainland can run higher compared to many free zones. You’ll pay fees for both initial and annual licensing, plus any office rental expenses. In most emirates, you’re required to have a certain amount of office space often measured in square feet per employee. If you need a larger team or aim to hire locally, be sure to plan ahead for your real estate budget.

- License fees typically renew each year and can fluctuate based on location.

- Office rent in prime commercial areas naturally costs more, though you might find more affordable solutions in less central regions.

- Certain emirates have set minimum space requirements for each visa you want to issue.

While these requirements might feel daunting, they also reflect your ability to operate freely in the local market, which can be a major advantage if on-the-ground presence is integral to your success.

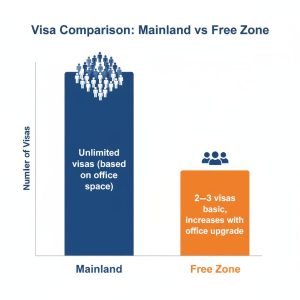

Visa and Hiring Possibilities

Securing visas for your team is a straightforward process on the mainland, and you’re generally not limited on the number of visas you can apply for, as long as you have enough office space to justify them. This can be vital if you plan to scale quickly. Once you have an established mainland license, you can sponsor employees, partners, or family members, provided you meet salary and housing requirements.

If you anticipate bringing in global talent or relocating staff from other countries, the mainland route might be more flexible. To keep track of the overall process of establishing a company in the country, you might also review how to setup a business in the UAE. This helps ensure you’ve covered all your bases, from opening a bank account to obtaining mandatory approvals.

Explore Free Zone Setup

Free zones are specific economic districts in the UAE that offer special incentives to encourage foreign investment. You’ll generally find streamlined procedures for incorporating your business, plus some financial perks and simplified customs processes. Although free zones have grown in popularity and for good reason there are also a few trade-offs you’ll want to note.

Special Licensing Framework

Unlike the mainland, free zones each have their own licensing authority. They’ll oversee your registration from start to finish, establishing rules about which business activities are allowed. Certain free zones cater to niche industries like media, technology, or logistics, giving you an environment filled with complementary companies.

- Many free zones focus on a handful of related sectors, which can encourage partnerships.

- Some free zones accept a broad spectrum of industries, but with different activity fees.

- You can often register fully online, cutting through red tape.

The biggest distinction is that free zone businesses usually cannot trade directly in the UAE local market without appointing a local distributor. If your core revenue stream depends on local customers walking through your door, that might be a deal-breaker. However, if you’re primarily dealing with international clients or you don’t mind the distributor route, a free zone license can still suit your needs.

Ownership and Legal Benefits

Most free zones in the UAE allow for 100% foreign ownership. You won’t need a local partner or sponsor, which can simplify your legal structure. Such autonomy appeals to many entrepreneurs particularly if you have a specialized business in a sector like fintech, media, or healthcare technology.

You also benefit from zero corporate or personal income taxes in many free zones, though it’s crucial to check the latest federal and emirate-level rules concerning corporate tax. Each free zone has slightly different tax treatments and incentives, so you’ll want to confirm that your chosen zone meets your expectations.

Cost Structures

Free zones often market themselves on competitive setup packages, bundling the license, office rent (or flexi-desk), and visa quotas. The overall cost can be lower than a mainland company especially if your operation doesn’t require a big physical presence. This on its own is a huge draw for startups looking to minimize overhead.

However, free zone renewal fees might rise annually, and you’ll have to maintain your lease agreement with the free zone to uphold the license. If your business expands and demands more space or more visas, your cost could increase accordingly.

Visa Quotas and Team Expansion

While free zone authorities do issue visas for owners and employees, the number of visas typically links to the size of your office facility. Many free zones start you with a handful of visas for a small office or flexi-desk. If you need to hire a larger workforce, you may need to upgrade to a bigger workspace and pay higher fees, which can add to your annual overhead.

- A small free zone license might offer two to three visas by default.

- Adding more visas usually requires scaling up your office plan.

- Some free zones make it simpler to sponsor family members if you meet a specific salary bracket.

If you anticipate rapid growth or need high-volume staffing quickly, confirm ahead of time whether the free zone can accommodate that expansion. Some smaller zones have tight caps on how many employees you can sponsor without relocating to a larger facility.

Weigh the Key Differences

When deciding between mainland vs free zone, many of the differences come down to how you see your business evolving and who your customers are. To clarify your path, it’s helpful to look more closely at four main considerations: location flexibility, market reach, tax obligations, and brand perception.

Location and Market Access

- Mainland: You can set up shop anywhere in the emirate, from high-end downtown offices to smaller industrial zones. Crucially, you can trade directly in the UAE market without needing a middleman or distributor. This direct access can be a game-changer if you’re aiming to tap into local customers or government contracts.

- Free Zone: Typically located in specific hubs that might be aligned to your sector, such as media, tech, or healthcare. While you can’t directly sell within the UAE local market without a local agent, you have easy access to global customers thanks to streamlined customs procedures, especially for importing and exporting goods.

Financial Implications and Taxes

At the federal level, the UAE has introduced corporate taxes for some businesses, yet many free zones continue to offer tax incentives if you meet certain compliance requirements. On the mainland, you may be subject to corporate tax depending on your revenue and activity, but you also get the advantage of operating onshore in a larger market.

- Mainland: Possibly higher overhead, but you can reach the UAE local market, which may offset expenses with robust domestic sales.

- Free Zone: Lower setup costs and potential tax benefits (depending on the free zone rules). Still, expansion often requires unlocking new packages and offices, which increases fees over time.

Brand Image and Credibility

There’s often a perception that mainland companies have broader recognition among local customers and government bodies simply because they’re recognized as an onshore entity. For many B2C businesses, having a mainland license can provide a sense of legitimacy in the eyes of customers who prefer dealing directly with local firms.

On the other hand, free zone companies are well-regarded internationally if you plan to serve a global market. Certain free zones specialize in building alliances between like-minded entrepreneurs, which may give you a reputation boost within your chosen industry.

Workforce and Growth Goals

- Mainland: Generally unlimited visas (subject to office space), plus straightforward hiring of local or international staff. Perfect if you plan to build a sizable local presence.

- Free Zone: Entry-level packages might only allow a handful of visas. To scale up, you need larger offices, potentially in the same free zone. Good for smaller teams or specialized companies but can be more expensive if your headcount skyrockets.

Decide the Right Setup

Ultimately, the right choice often hinges on the nature of your business model, your customer base, and your ambitions within the UAE market. Here are a few practical steps to help you decide:

- Identify Your Core Customers

- If you’re selling primarily to local customers or government clients, a mainland license might simplify your logistics.

- If most of your revenue is international, and you don’t mind using a distributor for local sales, a free zone could work.

- Estimate Your Staffing Needs

- When you aim to bring in a full staff from day one, the mainland might offer greater flexibility.

- If you plan to remain lean or virtual, a basic free zone package with minimal visas is often cost-effective.

- Assess Your Budget for Office Space

- Mainland licensing often comes with office space requirements that might cost more.

- Free zones typically offer smaller office setups or even a flexi-desk, letting you keep overhead low in the early stages.

- Review Legal Restrictions

- While many onshore activities allow 100% foreign ownership, certain sectors still need a local partner.

- Free zones nearly always grant full foreign ownership, removing the need for a sponsor.

- Outline Your Growth Path

- If you expect to pivot quickly into new product lines or high employee counts, verify that your chosen structure (mainland or free zone) supports that growth without hefty extra fees.

- Your brand perception might also matter if you’re seeking large local contracts or regional government ties.

Remember, the UAE has over 40 free zones, and each one offers slightly different benefits. Similarly, every emirate has its own regulations for mainland companies. Do your homework, talk to industry peers, and confirm the latest legal conditions so you know exactly what to expect.

Check a Quick Summary

Below is a bullet-point snapshot of everything you’ve learned, to help you compare the two paths:

- Mainland

- Direct access to the onshore market

- Office space requirements can be higher

- Potential for unlimited visas with sufficient space

- Possibility of 100% foreign ownership in many sectors

- Licenses generally cost more annually

- Free Zone

- Restricted local market access unless you use a distributor

- Typically lower startup costs, with bundled packages

- 100% foreign ownership is standard

- Limited visas based on office package

- Specialized hubs for certain sectors

Plan Your Next Steps

Launching a business in the UAE is a big move with exciting rewards. As you finalize your mainland vs free zone decision, keep in mind that either option can be adapted to your unique circumstances. Here’s how you can move forward with confidence:

- Pick your top priorities: local access, cost-saving measures, or ease of expansion.

- Shortlist a few free zones or compare a couple of emirates to see which licensing authorities are most flexible.

- Consult a reputable business advisory that knows the details around fees, office requirements, and market regulations.

- Stay open to scaling up or relocating, because the UAE’s business landscape evolves quickly.

You’ll soon find the setup that aligns best with your vision. Whether you choose the dynamism of the mainland or the specialized environment of a free zone, you’ll be part of a thriving ecosystem that can fuel your growth. Keep your eye on the bigger picture serving your customers and building a resilient team and you’ll tap into the many benefits this region has to offer. You’ve got this, and each step you take can strengthen your footing in one of the world’s most vibrant business hubs.