If you’re wondering about the cost to form an llc in the United Arab Emirates, you’re not alone. Many aspiring entrepreneurs and global investors look at the UAE as a promising market, but they’re often unsure about the financial commitments. In this article, we’ll walk through the main expenses you can expect and clarify how each piece fits into your overall budget. By the end, you’ll know what goes into setting up an LLC, what typical costs add up to, and how to keep surprises to a minimum.

Before we dive in, let’s be clear on one thing: prices can vary based on your chosen emirate, your business sector, and how much support or professional help you use. Still, the fundamentals remain consistent, so let’s explore them step by step.

Understand The LLC Structure

A Limited Liability Company (LLC) in the UAE is a business entity where your personal assets are protected from the company’s debts (hence the term “limited liability”). It typically requires at least two shareholders and can include both local and foreign investors. This structure is popular because it strikes a balance between protection and flexibility.

Local Sponsor Or Agent

If you choose a mainland LLC, you’ll need a local sponsor or agent (often a UAE national) who holds a percentage of shares but can sign an agreement granting you control over operations. The fee you pay the sponsor can vary. For some, this might be a one-time annual fee, while others might negotiate a profit-sharing agreement. Whatever route you take, make sure you and your sponsor are on the same page to avoid future complications.

Activities And Licensing

The license you get will depend on your business activities. An LLC can accommodate most commercial and industrial activities, but each activity might require extra permissions. If you’re interested in understanding how different types of LLCs compare, you can check out the differences between ltd vs llc, which highlights some structural nuances that could influence your costs.

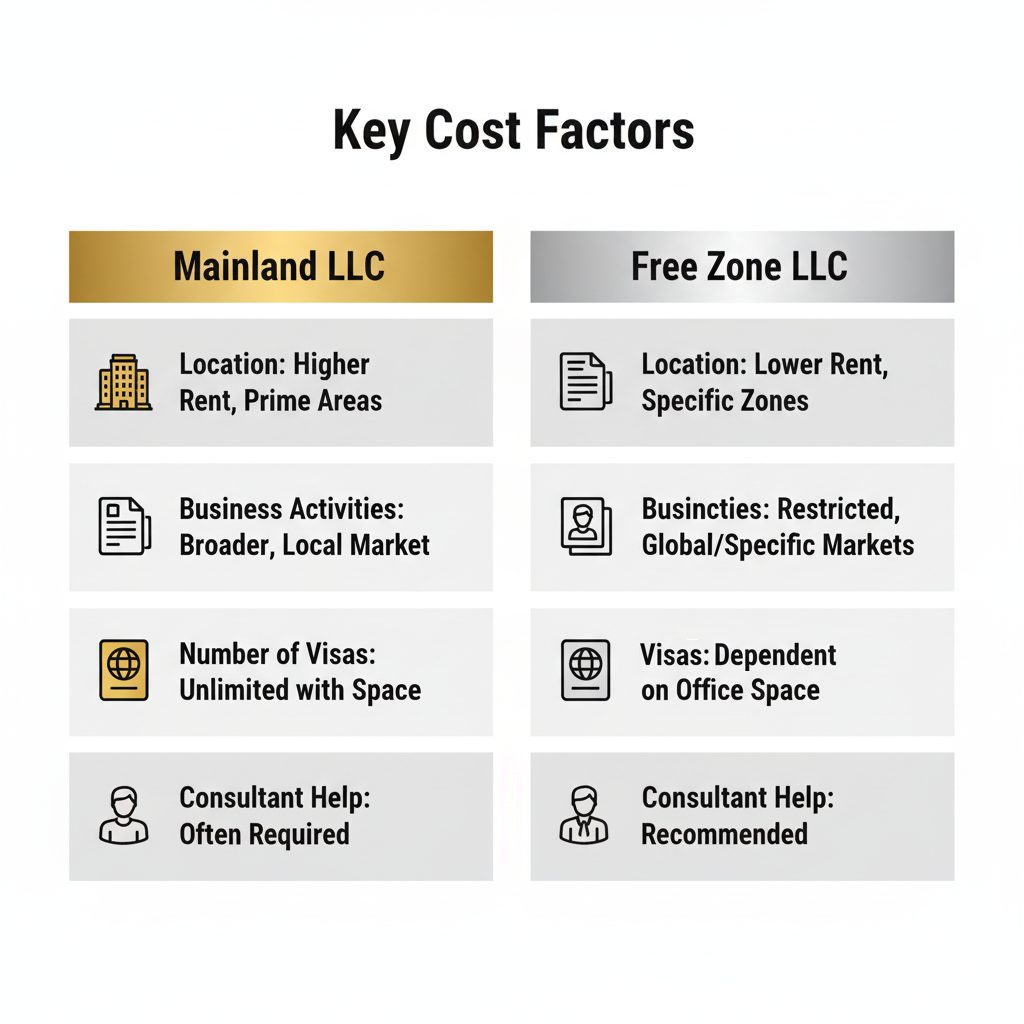

Explore Key Cost Factors

Several factors affect how much you’ll eventually pay. Let’s break down the major ones so you can plan accurately.

1. Location

Where you decide to establish your UAE LLC matters. Setting up in Dubai might carry a price tag that differs from Sharjah, Abu Dhabi, or other emirates. Also, some mainland jurisdictions offer cheaper registration fees, whereas certain free zones provide package deals for licensing and visas. For a deeper look at how geography influences price, you might explore the choice between mainland vs free zone.

2. Business Activities

Not all business activities have the same licensing requirements or cost. For instance, a consultancy license may be more straightforward, whereas a specialized manufacturing license can involve additional approvals. Typically, the more specialized your operations, the more steps (and fees) you might face for approvals from relevant government bodies.

3. Number Of Visas

If you intend to bring in employees or foreign partners, consider visa expenses. The visa quota is often linked to the size and nature of your LLC. These costs can include medical tests, Emirates ID fees, and residency stamps. If you need multiple visas, be sure to expand your startup budget accordingly.

4. Professional Assistance

While you can navigate the formation process on your own, many entrepreneurs prefer hiring a business setup consultant for peace of mind. Consulting costs vary, but they often save time, reduce procedural headaches, and help you avoid expensive errors.

Break Down Government Fees

Next up are the government charges you’ll need to factor in. These fees can be confusing if you’re new to the region, but understanding them can help you budget more effectively.

Trade Name And Initial Approval

You usually start by paying for a trade name reservation, which ensures your chosen company name is unique. Then you apply for initial approval to confirm that the authorities have no objections to your prospective business. Each step requires a separate fee, so keep these in mind early on.

Drafting The Memorandum

Most mainland LLCs require a Memorandum of Association (MOA), which outlines share distribution and legal responsibilities. You’ll pay to have this document prepared and notarized by a public notary. If you seek professional help drafting it, add in a service fee.

License Issuance And Renewal

Once your MOA is done, you’re on your way to getting your business license. The cost of business license in dubai or other emirates will depend on local rates. Typically, you pay for the initial license plus an annual renewal fee. These costs can shift from year to year, so building in some wiggle room for price adjustments is wise.

Chamber Of Commerce Fees

In some cases, you’ll also become a member of the local Chamber of Commerce, which involves a modest yearly fee. The exact amount varies based on your business category.

Consider Additional Expenses

Government fees form only part of the puzzle. Let’s talk about the added costs that can creep up and inflate your budget if you’re not careful.

Visa Quotas And Processing

Each employee (and often each foreign partner) needs a residence visa to legally operate in the UAE. The cost covers processing fees, medical exams, and other administrative items such as Emirates ID issuance. If your plan involves multiple employees, these fees can add up quickly, so plan ahead.

Renting Or Leasing Office Space

In the UAE, having a physical office space is frequently required for mainland LLCs. Even if you start small, you’ll need to comply with the local requirement of having an address and tenancy contract. Budgeting for rent is crucial, and prices vary based on the location within the emirate. Prime spots naturally cost more, but they might also bring in better visibility for your business.

Sponsor Or Service Agent Fees

If you have a local sponsor, you might pay a fixed sponsor fee. On top of that, you could also pay a service agent to handle official paperwork on your behalf, especially for specialized government transactions. Make sure these services are clearly spelled out in a contract to avoid hidden charges.

Administrative And Miscellaneous Costs

Other expenses include document translation, legal certifications, opening a corporate bank account, and obtaining stamps or letterheads. While each individual cost can seem small, together they can make a noticeable dent in your budget.

Compare Mainland And Free Zone

One of the most significant choices you’ll face is whether to form your LLC on the mainland or in a free zone. Each option has different costs and protocols, so let’s compare them briefly.

Mainland LLC

- Requires a local sponsor or service agent (unless you qualify for full foreign ownership under certain regulations).

- Allows you to do business anywhere in the UAE, including government contracts.

- Typically offers more flexibility in office location.

- Costs can be higher due to local sponsorship fees and certain additional steps.

Free Zone LLC (FZ LLC)

- Usually offers 100 percent foreign ownership.

- Provides package deals covering license, visa, and office space.

- Generally requires business activity within the designated free zone or outside the UAE.

- Limited to conducting business within that free zone, unless you extend your license or partner with a distributor for the mainland market.

- To learn more, check out the details of an fz llc in dubai.

Free zones can be a cost-effective choice for specialized industries or international trade. Mainland options, however, give you direct access to the local market. Choosing wisely can save you money in the long run, so consider your expansion plans.

Tips To Avoid Costly Mistakes

It’s easy to overlook some details when you’re excited about starting a new company. Here are a few common missteps and how to sidestep them.

1. Skipping Professional Advice

Yes, you can do it yourself, but the legal system can be tricky if you’re not well-versed in UAE regulations. Experienced consultants or specialized business setup agencies can guide you through the process, help with translations, and anticipate fees. If you prefer a more hands-on approach, keep an eye out for official government circulars or announcements, so you always have the most up-to-date information.

2. Underestimating Renewal Fees

A common mistake is forgetting that license renewals, sponsors’ fees, and other subscriptions often recur annually. Plan for these ongoing costs, and be aware that missing a renewal deadline can lead to penalties or even suspension of your business license.

3. Overlooking The Right Office Space

Some entrepreneurs pick an office that’s too large because they assume they’ll expand later, or they choose a prime location that hikes up the rent. It’s smarter to choose an office that fits your current operational needs. You can always upgrade when your business grows.

4. Not Matching Activities To License

Trade Name Reservation

Initial Approval

MOA Drafting & Notarization

License Issuance

Chamber of Commerce

Visas & Office Tenancy

If you decide to branch out into new products or services, confirm that your license covers these extra activities. Otherwise, you might land extra fees for approvals or, worst case, face penalties for operating outside your approved scope.

Example Cost Breakdown Table

To give you an illustrative snapshot, here’s a simplified table that shows a sample cost range for a mainland LLC in Dubai:

| Expense | Details | Approximate Range (USD) |

|---|---|---|

| Trade Name & Initial Approval | Reservation + initial permission to proceed | $500 – $1,000 |

| MOA Drafting & Notarization | Memorandum preparation + public notary | $300 – $700 |

| License Issuance (Year 1) | Issuance fee (renewed annually) | $3,000 – $5,000 |

| Sponsor Fee (Annual) | Local sponsor or agent agreement | $3,000 – $10,000+ |

| Visa (Per Person) | Medical, Emirates ID, stamping | $1,000 – $1,500 |

| Office Rent (Per Year) | Basic compliant space & tenancy | $5,000 – $10,000+ |

| Admin & Misc. | Translations, attestations, stamps, bank setup | $500 – $1,000 |

These numbers can fluctuate based on a variety of factors. Some free zones offer packages where license, visas, and office space come bundled. Meanwhile, premium offices in high-demand districts can easily surpass these figures. Treat this table as a ballpark and always request updated quotations from relevant authorities.

Learn Your Next Steps

Now that you know the bulk of what goes into forming an LLC in the UAE, it’s time to decide on the route that fits your business model and budget. You might find it strongest to start with a feasibility check, comparing the advantages of mainland vs free zone, or looking at how an LLC fares against other entities.

If you’d like to see a step-by-step approach, consider checking out how the process works in detail by reading about how to setup a business in the uae. This way, you’ll have a clearer sense of the paperwork, timelines, and potential fees at each stage.

Conclusion

Forming an LLC in the UAE comes with a mix of mandatory fees and optional services. The key to controlling the overall cost is understanding each step of the process, from choosing your location to structuring your local sponsorship arrangements. By doing ample research, seeking professional advice when necessary, and carefully budgeting for renewals and visa requirements, you’ll set up your LLC without breaking the bank.

Remember, no single cost figure applies to every UAE business. The best move is to gather quotes, compare options, and confirm that your desired business activities align perfectly with your license. Once you’ve nailed down these essentials, you can launch confidently in one of the Middle East’s most vibrant business markets — and focus on what matters most: growing your enterprise.