If you’re curious about the difference between an LTD and an LLC in Dubai, you’re not alone. Many aspiring entrepreneurs wonder which structure offers the best path toward a successful venture. Understanding the unique roles these two company types play can help you make an informed decision.

In this article, we’ll explore how each structure works, what sets them apart, and why it matters to you. We’ll also highlight key factors like ownership rules, liability limits, and local regulations. By the end, you should have a clear picture of which format aligns best with your goals, budget, and strategic vision.

Understand Key Terms

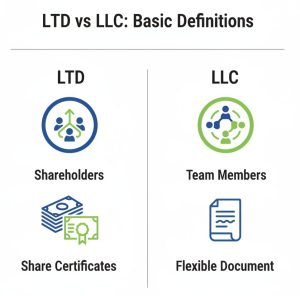

When you see “LTD” or “Limited Company,” think of a private entity with a predefined share capital (the total value of all shares) and a restricted number of shareholders. In many regions, “LTD” is shorthand for “private limited company,” usually with share ownership carefully divided among investors. An “LLC,” on the other hand, is a Limited Liability Company, which balances flexibility and liability protection for its owners. In Dubai, both terms refer to structures that safeguard personal assets while still allowing you to run a wide range of business activities.

Amid all the acronyms, it’s normal to feel a bit lost, especially if you’re new to the UAE’s legal system. Still, the core function of an LTD and an LLC is to shield you and your partners (if applicable) from direct financial responsibility in case of lawsuits or debt. While both provide limited liability, the exact rules for ownership percentage, governance, and financial disclosure can vary based on local regulations. That’s why understanding the fundamental distinction between an LTD and an LLC is crucial before you commit time or resources.

Compare Ownership Structures

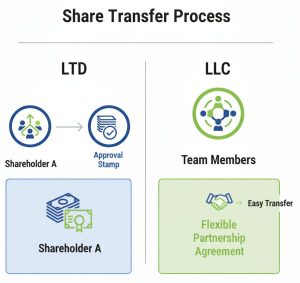

Ownership is one of the first areas where an LTD and an LLC in Dubai can differ. An LTD often has a defined share structure, meaning each shareholder has a specific number of shares that represent their stake in the business. It may also involve stricter rules on how shares are transferred. An LLC, however, might offer more flexible partnership arrangements. In some cases, you can bring in additional members without the same formalities required by an LTD’s share allocation process.

Specific local regulations can also impact your ownership options, particularly if you plan to operate in a Dubai mainland setup or one of the free zones. For an in-depth discussion on how these geographies shape your decisions, see our comparison of mainland vs free zone. You might also come across FZ LLC (Free Zone LLC) structures if you operate in special economic zones, which can remove the need for a local sponsor. More details about that are in our guide on fz llc in dubai.

Consider Licensing And Compliance

Both LTDs and LLCs require a valid business license to operate in the UAE, but the specific type may differ according to your business activities. For instance, a trading firm could need a commercial license, while a consultancy might need a professional license. If you want to learn about the various licenses available, check out our overview of types of business licenses in the UAE.

Compliance obligations tend to be more stringent when you establish a mainland LLC in Dubai, partly due to local ownership regulations. In certain sectors, you may need a 51 percent local partner, unless you qualify for 100 percent foreign ownership under updated laws. Meanwhile, an LTD established in a free zone could enjoy simpler reporting requirements, though each free zone sets its own rules. Make sure you consult official documentation and, whenever necessary, get professional advice to confirm whether your chosen structure meets all mandatory regulations.

Liability Protection And Legal Framework

Both LTD and LLC structures provide a layer of separation between personal and company assets. If your company faces a lawsuit or gets into debt, your liability generally remains limited to the amount of your individual investment. However, the codes regulating these structures in Dubai can impose different financial reporting standards. Depending on the size and nature of your venture, you might need audited financial statements or regular compliance checks. Always verify the latest laws, because regulations can evolve over time to adapt to market conditions.

In practice, the liability aspect between an LTD and an LLC in Dubai often looks similar, especially after recent reforms aimed at encouraging foreign investment. In many cases, both structures are viewed as safe bets for entrepreneurs. Your biggest advantage is that personal assets, such as your home or savings, typically remain untouchable if the business faces trouble, though exceptions may apply in cases of serious legal breaches.

Review Capital And Funding Options

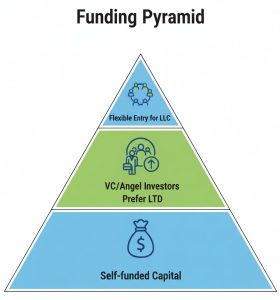

If you’re aiming for external investment, such as venture capital, you may discover that some investors prefer an LTD-like structure because it can be easier to formalize shareholding. Others might not mind an LLC, especially if you offer them sufficient ownership stakes or board representation. Minimum capital requirements vary depending on whether you register in a free zone or mainland. Some jurisdictions impose only a symbolic capital deposit, while others set a higher threshold to ensure you have the financial backbone to sustain operations.

An LTD typically spells out the distribution of shares right from the start, making it a bit simpler to onboard new shareholders who want a clear equity slice. With an LLC, you can still attract external funding, but you might need to rework partnership agreements or reorganize ownership percentages to bring new members on board. Carefully consider how crucial outside funding is to your business plan, because your legal structure can either speed up the process or introduce extra layers of complexity.

Explore Management And Control

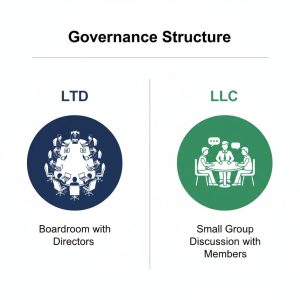

In an LTD, a top-down structure is common. Owners, who are also shareholders, typically appoint directors or board members to oversee day-to-day operations. Shareholder agreements govern how decisions get made and how profits get distributed. An LLC often grants members more hands-on control, which can be attractive if you want direct input on operational decisions.

Just keep in mind, local regulations in Dubai might require specific governance arrangements. For instance, certain high-profile industries demand that at least one board member be an Emirati national, depending on the business model.

You should also watch out for any clauses that limit your power to make independent decisions, particularly if you’re working with a local sponsor. A carefully drafted Memorandum of Association (MOA) spells out roles, responsibilities, and voting rights. It is not uncommon to hire a corporate lawyer to iron out the fine print, helping you avoid disputes or confusion down the line.

Compare Costs And Fees

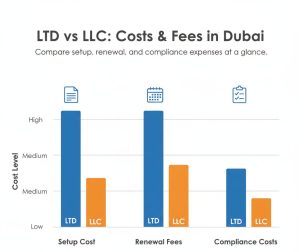

LTDs and LLCs in Dubai can both come with incorporation costs that vary based on location, licensing fees, and government charges. Free zones usually publish a transparent fee schedule, while mainland setups might include extra expenses for local partnering. Ongoing costs, such as renewal fees or annual auditing, also differ.

Since an LTD may involve more structured reporting, you might incur slightly higher administrative charges. But those fees could be well worth it if the structure helps you secure better funding or investor confidence.

Deciding which option is cheaper in the long run requires looking at the total cost of ownership, including licensing fees, compliance costs, and any legal expenses for drafting agreements. Sometimes, entrepreneurs opt for an LLC in a free zone to unlock cost savings, but this might limit your market scope if you plan to serve customers on the Dubai mainland. Balancing these factors is part of picking the right path.

See A Quick Comparison

The table below summarizes the main points that set an LTD apart from an LLC in Dubai. Use it as a handy reference when mapping out your business structure.

| Feature | LTD (Limited Company) | LLC (Limited Liability Company) |

|---|---|---|

| Ownership Structure | Share-based, with set share allocation among investors. | Flexible membership system, typically fewer formalities for adding or removing partners. |

| Liability | Personal assets generally protected, liability limited to share capital. | Similar protection, with liability typically capped at each member’s investment. |

| Capital Requirements | May require defined share capital. | Minimum capital can vary. Some free zones have minimal capital standards, while others differ. |

| Share Transfer | Potentially complex, with formal procedures and approval needed. | Generally simpler, though you may still need updated agreements for new members. |

| Management | Directors or board often appointed by shareholders. | Owners can play a direct role, though some industries require special governance. |

| Regulatory Compliance | Varies by license type, but can involve more structured reporting. | Similar obligations, but certain free zones offer more streamlined compliance. |

Choose Your Ideal Option

So, which option suits you best? Your decision often comes down to your funding needs, scale of operations, and personal involvement. If you want a traditional share system that clearly outlines equity stakes, then setting up an LTD could be a great way to keep all investors on the same page.

On the other hand, if you favor a more flexible arrangement and plan to partner with local or international collaborators, an LLC may feel more practical and less rigid. Either way, both structures can offer robust security for your personal assets, which is a key motivator for many business owners venturing into the Dubai market.

Before you lock in your choice, consider the nature of your business (service-oriented, trading, e-commerce), your target customers (local, global, or mixed), and any potential investors you want to attract. Think about how your ownership structure and licensing obligations will shape your daily priorities.

If you are new to the region, you might want professional guidance to navigate the nuances of local law. Our guide on how to setup a business in the uae covers everything from initial planning to final registration, giving you a clearer roadmap to success.

Final Thoughts

The difference between an LTD and an LLC in Dubai might seem nuanced, but it can seriously shape your growth prospects, funding strategies, and operational efficiency. By taking the time to compare ownership rules, liability protection, and cost structures, you position your enterprise for success.

Remember that regulations evolve, so always keep an eye on official updates or seek professional advice if you’re unsure which path to take. If you plan carefully and follow the essential steps, you can enjoy the many benefits of setting up a business in this fast-paced, global city. Once you choose the right company structure, you’ll be well equipped to launch, and thrive.